Valuation of Alphabet

Hello folks! Since have I learned Valuation my aim is to find the intrinsic value of a company. Today I will write about valuation on Alphabet. Enjoy!

Introduction

Every valuation starts with a narrative, a story that you see unfolding for your company in the future. In developing this narrative, I will try to make assessments for the company (its products, services, and management), the market, the competition, and the macro environment in which operates trying to:

1. Keep it simple.

2. Keep it focused.

3. Stay grounded in reality.

Alphabet Narrative: Possible, Plausible and Probable

In June 2023 my narrative for Alphabet is:

1. Global and leading company in advertising.

2. The third company in cloud computing services will be improved from the AI landscape (positive margins).

3. Will remain a Global company with 85% of desktop users using Google Search machines.

4. High revenues and margins but also a high reinvestment rate to keep a sustainable competitive advantage.

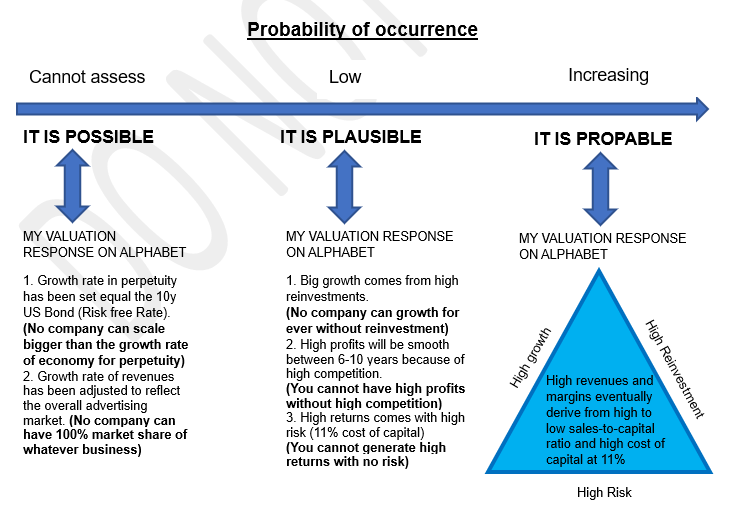

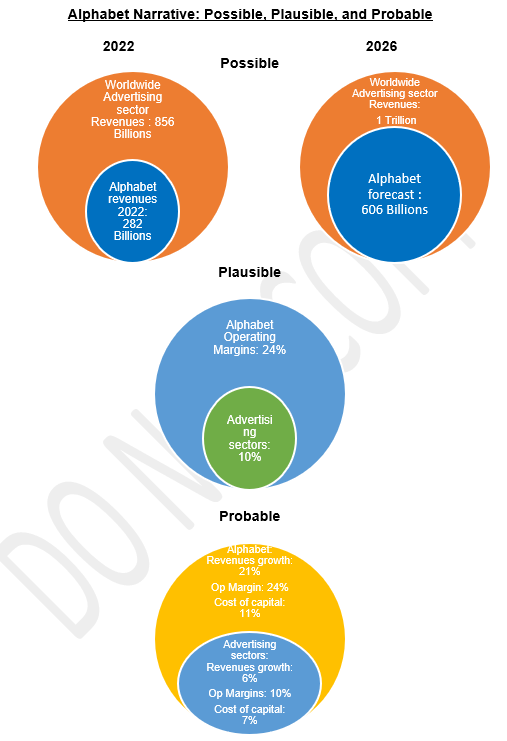

Since I have set up my narrative for Alphabet, I will check it against history, economic first principles, and common sense. You can check my two photos below.

Valuation of Alphabet

Alphabet is clear that wants to make big investments in AI to keep the competitive advantage, which comes from high operating income relative to the advertising sector. Between 1-5 years company will have high and stable operating margins and at the same time will create value more efficiently from the competitors. Between 6-10 years the competitive advantage will smooth, and operating margins/efficiency will be slightly above the advertising sectors. High competition from Facebook and AI sector will lead at the drop of operating margins. Finally, after 10 years (for perpetuity), competitive advantage of the company would have been eliminated entirely, revenues will grow at steady pace of 3.7% (US Risk free rate) and the operating margin would be equal to the average of advertising sector (US).

Value as of Jun 15, 2023

Terminal cash flow = $ 85,909.70

Terminal cost of capital = 7.00%

Terminal value = $ 2,643,375.33

PV(Terminal value) = $ 1,058,116.40

PV (CF over the next 10 years) = $ 470,158.47

Value of Operating Assets = $ 1,528,274.87

Value of operating assets = $ 1,528,274.87

- Debt $ 27,200.000

- Minority interests $ -

+ Cash $ 21,876.000

+ Non-operating assets $ -

Value of equity =$ 1,522,950.868

- Value of options= $0.00

Value of equity in common stock= $ 1,522,950.868

Number of shares= 14,040.00

Estimated value /share= $108.47

Price= $124.00

Price as % of the value= 114.31%

Under/Over Value= -14.31%

Conclusion

A good valuation stands between the numbers and narratives. I tried to make estimations in fundamental factors, looking at the history of the company and then I adjusted them to reflect the high competition and the macroeconomic effects. The main advantage of Alphabet is its adverting services and the domination of the Global share of (advertising) market. To keep the competitive advantage of high operating margins (cost advantage) and Global share market (85% of total desktop users), the company needs high reinvestment rates and at the same time a high cost of capital. As a result, for my taste, Alphabet is overvalued by about 14% and I will not pay the price of the market offers. I hope all of you have good investments and thank you for supporting my work.

You can purchase my Valuation report on Alphabet for FREE here: https://readysetvalue.gumroad.com/l/bdopn

Furthermore, you can check:

My Facebook Page: https://www.facebook.com/readysetvalue

My personal Website: https://www.readysetvalue.xyz/

My Valuation work on Amazon.com: https://readysetvalue.gumroad.com/l/ltdht

Support my work: https://ko-fi.com/anagnostouevan